Share

The answer to the question “what does Bitcoin actually do?” lies in the ancient Buddhist parable of “the blind men and an elephant”. In this story, a group of blind men encounter an elephant for the first time, and try to identify what the elephant is and does by touching different parts of it. Whilst the image below is a cartoonish simplification of the parable, the point still stands: the individual descriptions or assessments of the elephant are dramatically different across the cohort of blind men. This is no different to how different people come to different conclusions on what Bitcoin is or does, depending on their own personal context.

Bitcoin is a very promising technology, however due to its leaderless, decentralised nature, it cannot and does not make any promises about the future. There are several things that Bitcoin guarantees however. The distinction between Bitcoin’s guarantees and the promises touted by various proponents is discussed below.

Bitcoin’s guarantees

Whilst there are no individuals or entities behind Bitcoin, Bitcoin’s fundamental code provides, at least, the following three guarantees that were set in stone upon Bitcoin’s release on 3 January 2009:

- Proof-of-work consensus mechanism

- Censorship/seizure resistance and Permissionless

- Fixed supply of the underlying monetary unit, bitcoin

These guarantees can be relied upon by all users, attract new users and investors, and form the basis of “what Bitcoin actually does”. These guarantees have been offered since the launch of Bitcoin, and remain in place regardless of its market price. Indeed, Bitcoin did not even have a market price for nearly the first two years of its life. Any other function or use case touted by Bitcoin proponents are effectively ambitions or promises that are undergirded by Bitcoin’s three headline guarantees.

Proof-of-Work Consensus Mechanism

A consensus mechanism is what allows a large decentralised network of anonymous (and even distrusting) individuals to agree on the state of a network. There are several different ways to reach consensus, and the Bitcoin network uses a system known as Proof-of-Work (PoW) to do so. This piece will not go into the technicalities of PoW, rather, it will highlight the guarantees that PoW affords to Bitcoin’s users.

Firstly, PoW ensures that new bitcoins are not conjured up out of thin air at no cost, but rather through a fair and competitive process of computational work whose expense is tantamount to the market price of bitcoin. To put it another way, if the market price of a bitcoin is $20,000, then the cost of the energy required to mine a coin will approach $20,000. Further, PoW rewards actors who are playing by the protocol-defined consensus rules, and actively punishes those who don’t.

Secondly, PoW guarantees immutability of Bitcoin’s decentralised ledger. Immutability in this context means that once a transaction is added to a sufficiently large, distributed and high-powered PoW-based blockchain, it becomes increasingly difficult, if not impossible, to reverse. Let’s say I spent one bitcoin a year ago, and I wanted to attempt to spend it again today. I would be required to redo all work that had been undertaken by the network for the past year, as well as maintain a lead over the rest of the network going forward so that consensus would form around my chain of work. In reality, and in light of Bitcoin mining currently drawing roughly 0.5% of the world’s electricity, this is now an impossible task (however, Bitcoin’s PoW was vulnerable to such attacks in its early life). In fact, it becomes probabilistically impossible to double-spend bitcoin after 6 blocks have been added to The Blockchain. This means that Bitcoin users are guaranteed settlement finality about an hour after they send or receive a transaction.

Censorship/Seizure Resistance and Permissionlessness

Individual and even state level transactions are subject to the prevailing laws of the land, and can be blocked or reversed (i.e. censored). A contemporary example is Russia’s default on its sovereign debt payments due to being locked out of the global financial system due to sanctions. Another relevant example is the wholesale “de-banking” (i.e. censorship) of individuals and cryptocurrency startups in Australia which triggered the establishment of an Australian Senate Committee headed by Senator Andrew Bragg. Legacy payment rails aside, cryptocurrency exchanges and third-party wallet providers frequently censor transactions (including Bitcoin transactions) based on blacklists compiled by ‘chainanalysis’ companies in an attempt to stop the flow of cryptocurrency that may be in violation of anti-money-laundering or other financial market regulations. That said, should an individual or entity use the Bitcoin reference software and wallet, Bitcoin Core, they are guaranteed to be able to send bitcoin to or receive bitcoin from another Bitcoin Core user, with no possibility of censorship.

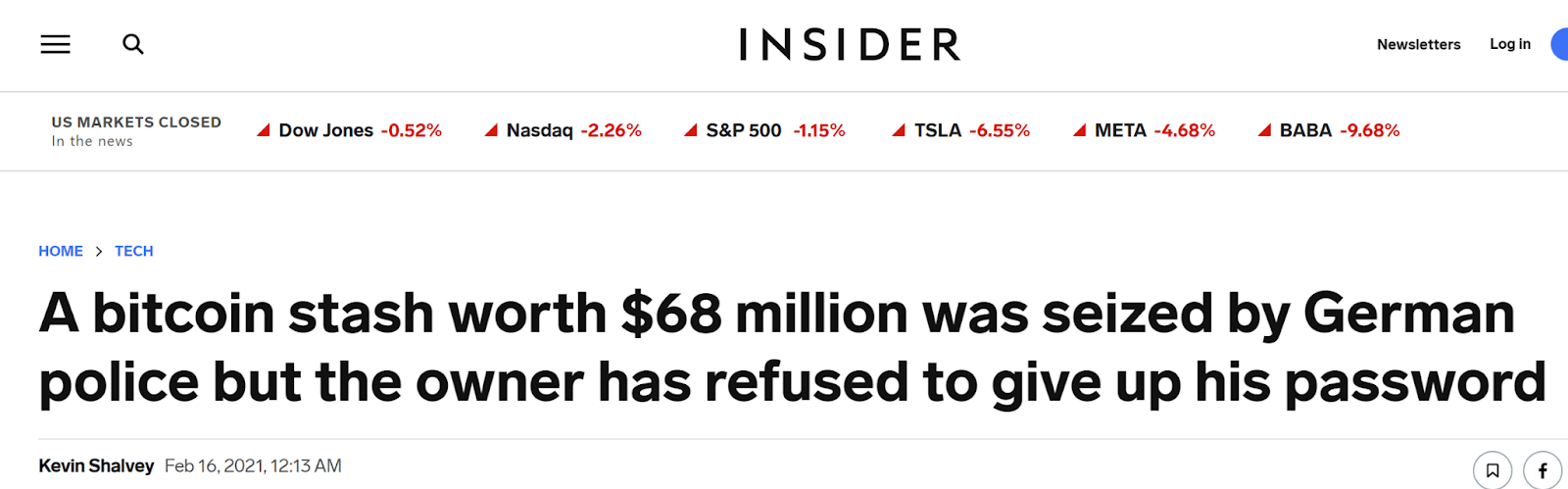

Closely related to censorship resistance is seizure resistance. Effectively, sending bitcoin is simply sending a message over the network. This message is made up of the transaction details and signing this message with a private key. Whoever holds the private key is guaranteed access to these funds. In the event of an attempted seizure, whether by malicious actors or a government, unless these keys are voluntarily handed over by their owner, it is impossible to have them taken away. Whether or not a seizure can be successful depends on how much the private key owner values their freedom (or life) in the face of legal or violent threats.

Image Source: BusinessInsider.com

Permissionlessness is similar to, but differs slightly from, censorship resistance. In this context, it means that you do not require permission or approval from a central authority to participate. In Bitcoin’s context, this means that a user is guaranteed access to the transaction verification process by simply downloading the reference wallet (this process is known as “running a node”). Once a user becomes a node on the network, they are guaranteed access to their funds at all times, and can use their bitcoin as they see fit. This is unlike users in legacy systems who sometimes have to provide reasons and justification to their banks when transacting in fiat currency.

To summarise this trifecta of closely related guarantees, so long as you are running a bitcoin node, you do not need permission to send or receive bitcoin, cannot be stopped from sending or receiving funds, and so long as your private keys are not exposed to other entities, you can even choose to take them with you to the grave.

Limited Supply

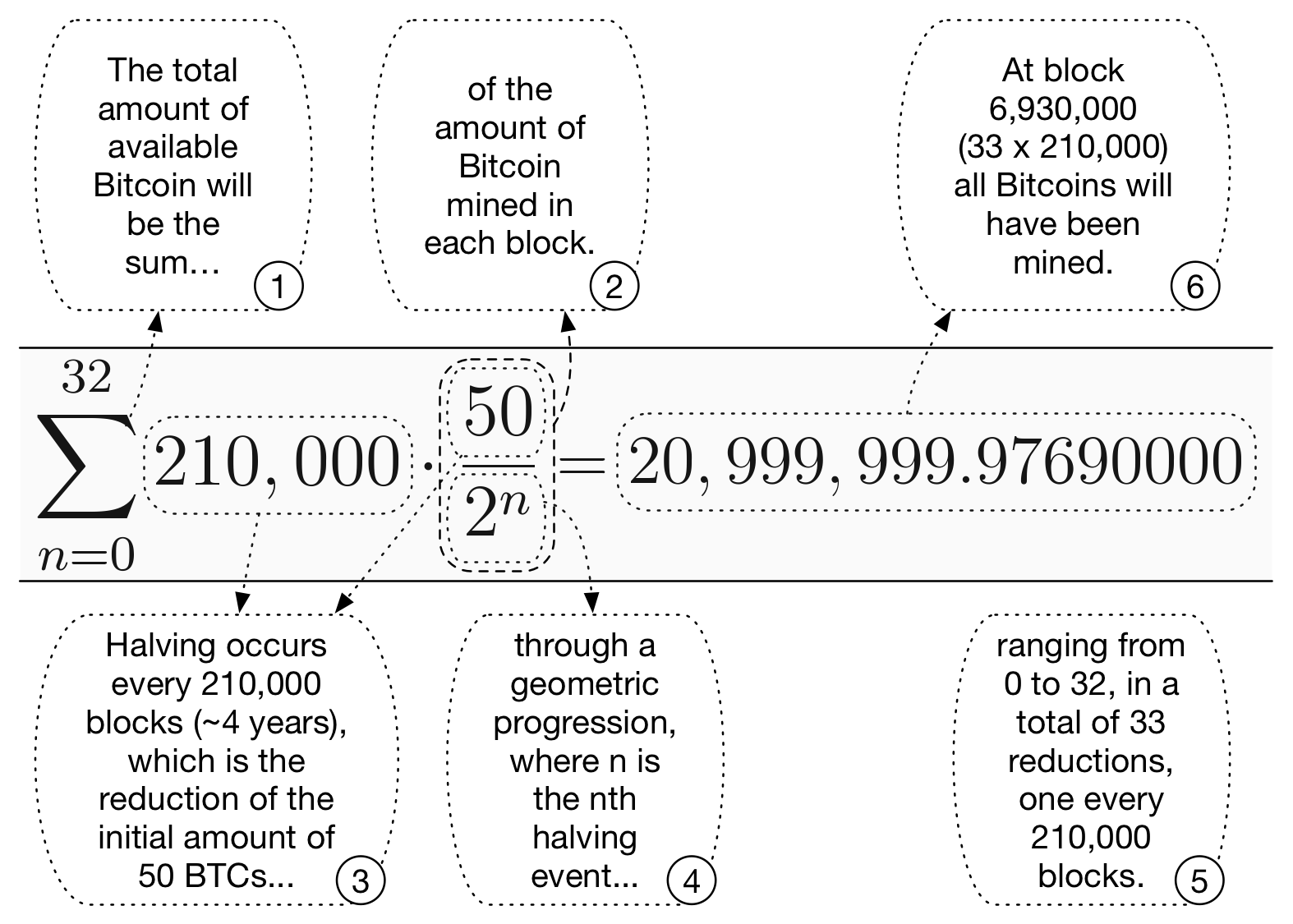

Bitcoin’s emission schedule is strictly governed by Bitcoin's code, and cannot be altered. It can be mathematically expressed as the sum of a series of thirty-three periods of 210,000 blocks, as shown in the figure below. The per block emission during the first period was equal to 50 bitcoins, and will halve thirty-two times over a period of roughly 130 years. We are currently in the 4th reward era (i.e. there have been 3 emissions halvings), where 6.25 bitcoins are mined per block. As at 30 June 2022 there are currently ~19,079,900 bitcoins in circulation, roughly 90.5% of the total supply. At the end of the distribution process, there will be precisely 20,999,999.9769 bitcoins, which is commonly rounded up to a neat 21 million by Bitcoin proponents for ease of communication and explanation.

Many Bitcoin proponents will say that this predictable and fixed supply schedule makes Bitcoin a useful hedge against inflation. In reality however, this is just another blind man’s projection. The world is currently witnessing inflation not seen in decades, and in some jurisdictions, not seen in generations. Meanwhile, Bitcoin and other crypto-assets are down between 70% and 95% from their 2021 highs. Bitcoin makes one simple guarantee - the bitcoin you own cannot be debased under any circumstances in bitcoin terms. If you own 21 bitcoins, you are guaranteed to always own one one-millionth of the total supply.

Conclusion - Bitcoin The “Dumb Rock”

Whilst Bitcoin is indeed an amazing, revolutionary technology, the advent of “smart” cryptocurrencies has led many critics to call Bitcoin a “dumb rock” in comparison and to ask the question “what does Bitcoin actually do?” This piece has shown that Bitcoin does not in fact do much at all, but does a few very important, and desirable, things very well. With Bitcoin, you have an unstoppable money that cannot be debased or seized, and thanks to its Proof-of-Work consensus mechanism, an underlying protocol that is secure and safe from meddling and change, even generations and centuries into the future. When something is so “dumb”, very little can go wrong at the protocol level. When physical engineering structures like bridges or buildings fail, it is very rarely due to deficiencies in the design of concrete and steel members, but rather, in failing to adequately engineer the underlying foundations. Founding on “dumb rock” is usually the preference, and it is the “dumb rock” of Bitcoin which allows programmers and entrepreneurs to build layered infrastructure, such as the Lightning Network, on a solid, immovable foundation.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.