Share

Foreword

Bitcoin has been garnering significant attention as it begins to be adopted by a wider range of investors. The investor base is starting to shift from retail investors to large institutions. Naturally, questions regarding its volatility and legitimacy as an investment opportunity will arise. This paper will address such questions and provide solutions to including and managing Bitcoin in a well structured portfolio.

1.0 Bitcoin as an Asset

Bitcoin launched in 2009 as the first cryptocurrency to introduce and use a distributed ledger (“Blockchain”) to guarantee the scarcity of its native monetary unit, and has a current market capitalization of ~AUD $1,500BN. Since its launch, Bitcoin has generally demonstrated three performance characteristics: High returns, high volatility and low correlation to traditional assets.

Whilst Bitcoin can be compared to a raft of other assets based on particular criteria, it stands alone when viewed as a total package. Bitcoin is a software protocol first and foremost, however, it is obviously not “just software”. Bitcoin shows many traits of different financial assets, but it is not strictly confined to cash, bonds or equities. Bitcoin is software, finance, and ultimately, a socioeconomic phenomenon all put together, that has found value in the marketplace.

2.0 Volatility

2.1 How Volatile is Bitcoin?

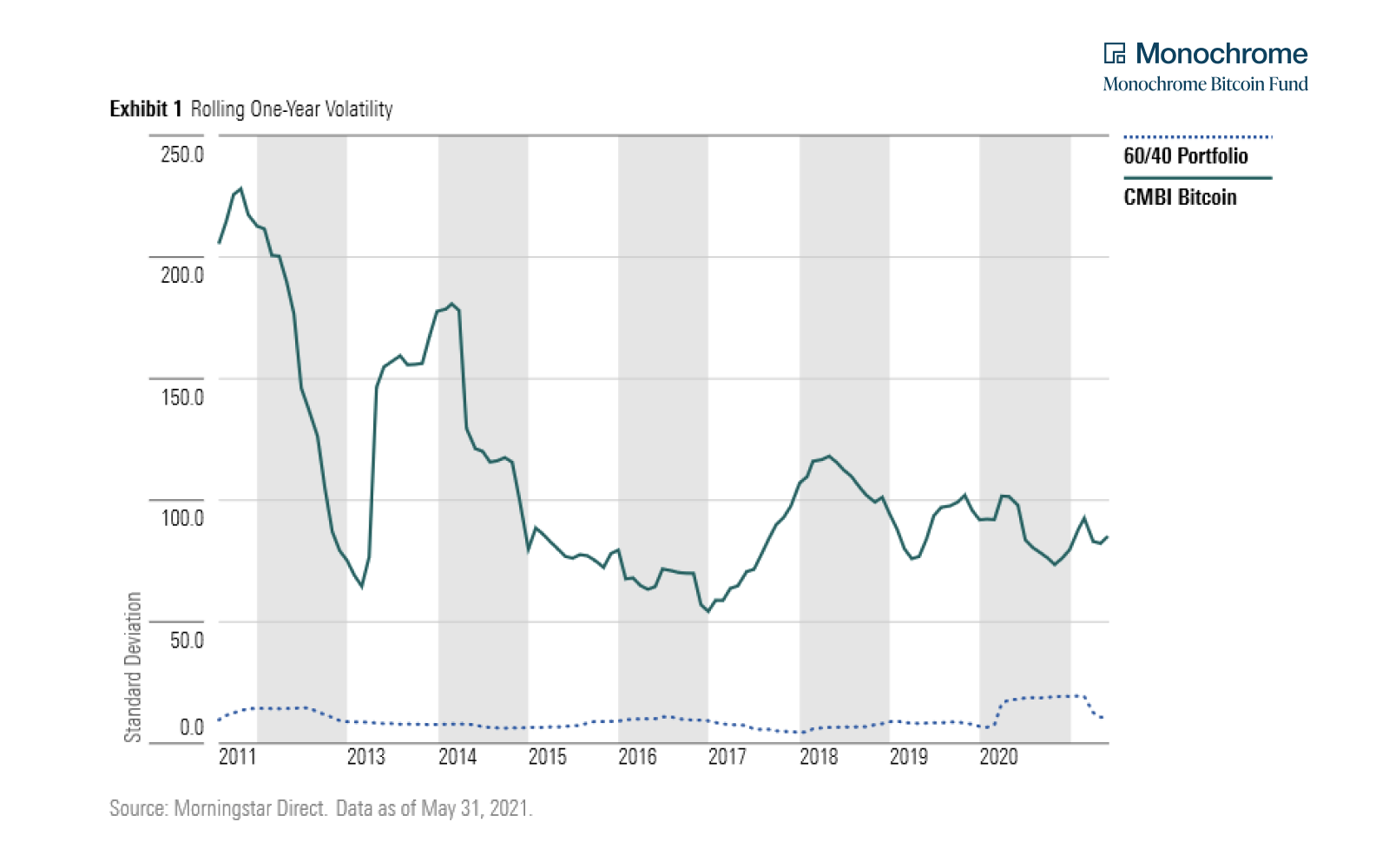

One of the main concerns people might have about Bitcoin is volatility. Intraday, daily, annual, or peak to trough measures all illustrate the high volatility that accompanies the historically high returns. Graph 1 below shows the volatility of Bitcoin against a traditional 60/40 portfolio.

Graph 1: Volatility of Bitcoin against a traditional 60/40 portfolio.

2.2 Why is Bitcoin so Volatile?

Bitcoin’s volatility boils down to its design and position in the market as a nascent asset class. There is no central bank to govern the supply of Bitcoin, meaning that its price can’t be supported when it falls, unlike traditional currency and bond markets. As a result, the price of Bitcoin is determined entirely by the market, governed by the laws of supply and demand. However, Bitcoin has a perfectly inelastic supply curve - where supply cannot keep up with demand, this leads to spikes in price. Its supply is finite much like gold or coal, but the differences are in the way it is mined. The framework is coded such that there is a maximum of 21 million Bitcoins available, with 18.7 million currently in circulation. Mining becomes progressively harder as more people join the mining network and the size of the rewards halve every 210,000 blocks, or roughly 4 years (referred to as a “halving”).

With the digital asset industry in its early stages, and Bitcoin at the forefront of it, speculation and market sentiment plays a large factor in its pricing. This allows recent events such as China’s cryptocurrency crackdown, El Salvador’s Bitcoin legal tender law or even comments from public figures to move its price significantly.

The Bitcoin market isn’t viewed as one that requires expertise like the real estate or stock markets. This, combined with the low barriers to entry, attract “fragile investors” who invest hoping to make quick gains but withdraw soon after losing patience. This frequent entry and withdrawal contributes to its volatility. Furthermore, with inconsistent approaches in the regulation of digital asset exchanges and lending services internationally, there are extreme levels of leverage in the ecosystem, which can lead to liquidation cascades on both the long and short side that see 10%+ market moves in a matter of minutes.

Finally, much of Bitcoin’s price is sentiment or “narrative-driven”, in that there is a prevailing market thesis about what Bitcoin is at this particular moment in time, and the asset is priced accordingly. We will discuss the nature of the narrative in the next section. Indeed, there may be nothing in the world quite as volatile as a simple narrative.

2.3 Future of Bitcoin Volatility

Recently, the volatility of Bitcoin has begun to reduce. The three month realized volatility fell to 86% from 90% in February 2021; and the six month realized volatility was 73% (Graph 1). Strategists have stated there are tentative signs of Bitcoin’s volatility normalizing and described them as “encouraging”, ultimately setting the landscape for institutional investors to gain Bitcoin exposure.

The CFA Institute expects Bitcoin’s high but declining volatility to continue as Bitcoin becomes an increasingly accepted form of investment.

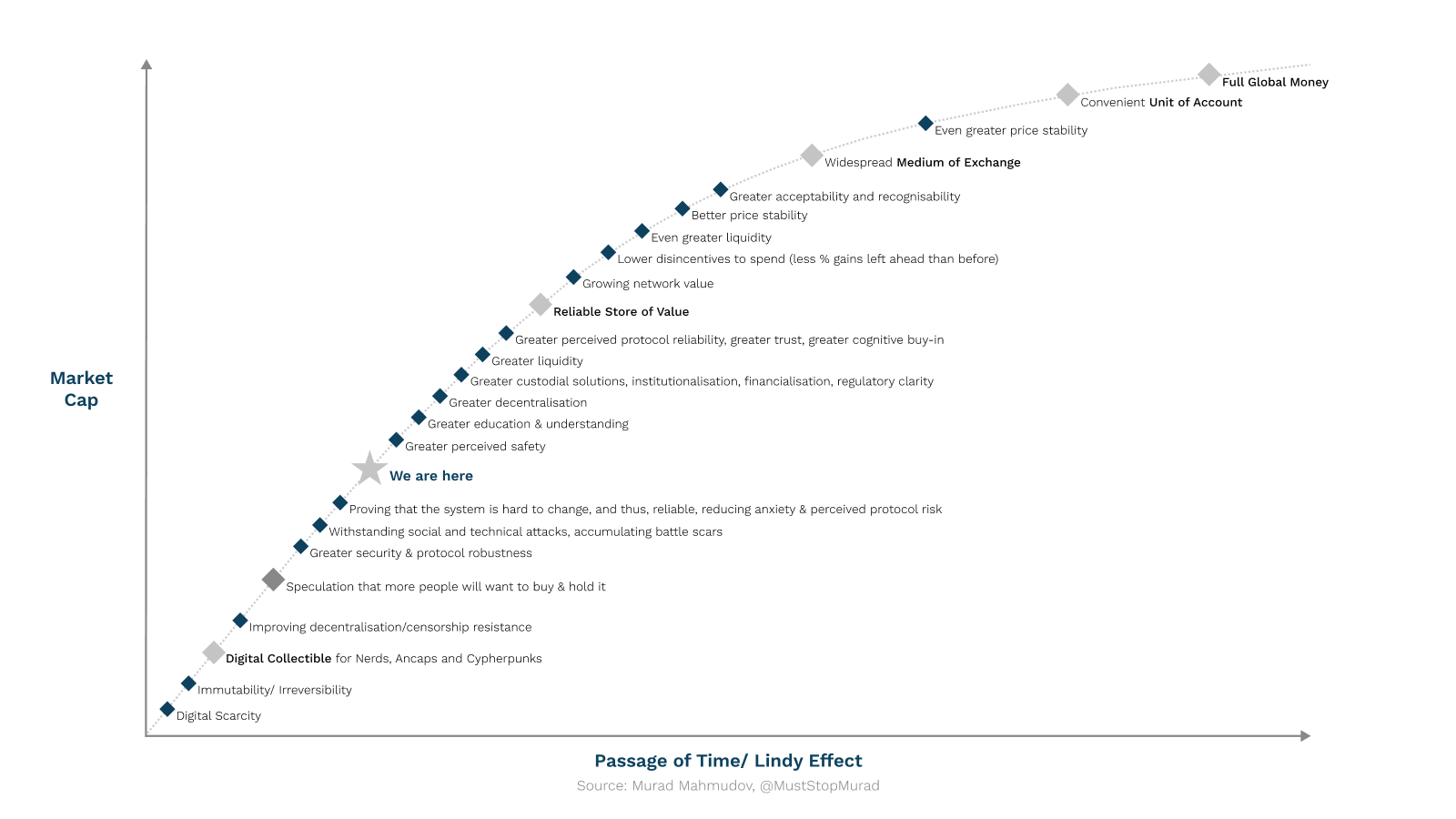

As referred to in the previous section, Bitcoin has followed and will likely continue to follow a changing narrative. Graph 2 below shows a framework developed by Bitcoin analyst Murad Mahmudov, which traces the evolving nature of Bitcoin over time. Each time period paints Bitcoin in a different light. At the beginning, it was considered a novelty token for cypherpunks (individuals advocating widespread use of strong cryptography and privacy-enhancing technologies), then began comparisons to gold and now we are starting to see it become a banking system to the unbanked. Whilst this framework was developed in mid-2018, we are realistically just under half way between the 2018 “We are here” marker and the “Reliable Store of Value” marker, perhaps at the “Greater Decentralisation” square, and closely approaching the “Greater regulatory clarity” marker. Volatility will likely stay relatively high until Bitcoin has evolved into a widespread medium of exchange, which could be well over a decade or more away, if ever at all.

Most importantly, well understood and managed volatility should be embraced, not feared. The speculative calls for a $1m+ Bitcoin price as a recognised global money necessarily implies high levels of risk and volatility on the pathway there.

Graph 2: The Monetary Evolution of Bitcoin

3.0 Correlation of Bitcoin

3.1 Low Correlation to Traditional Assets

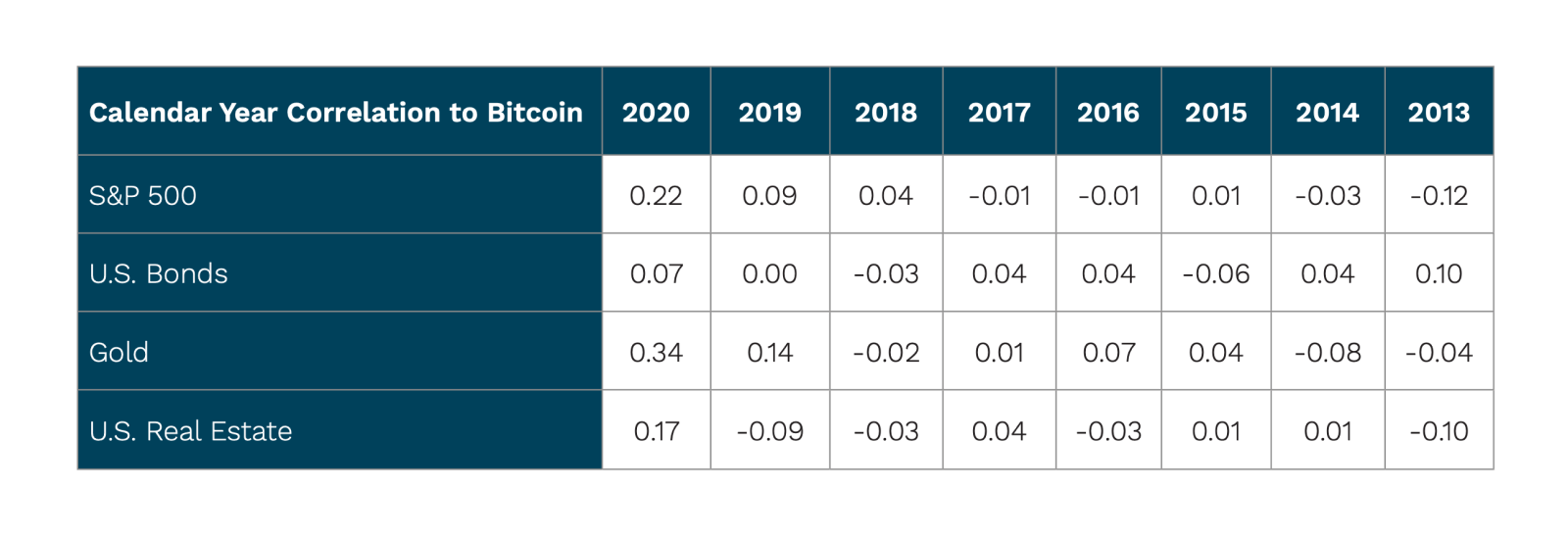

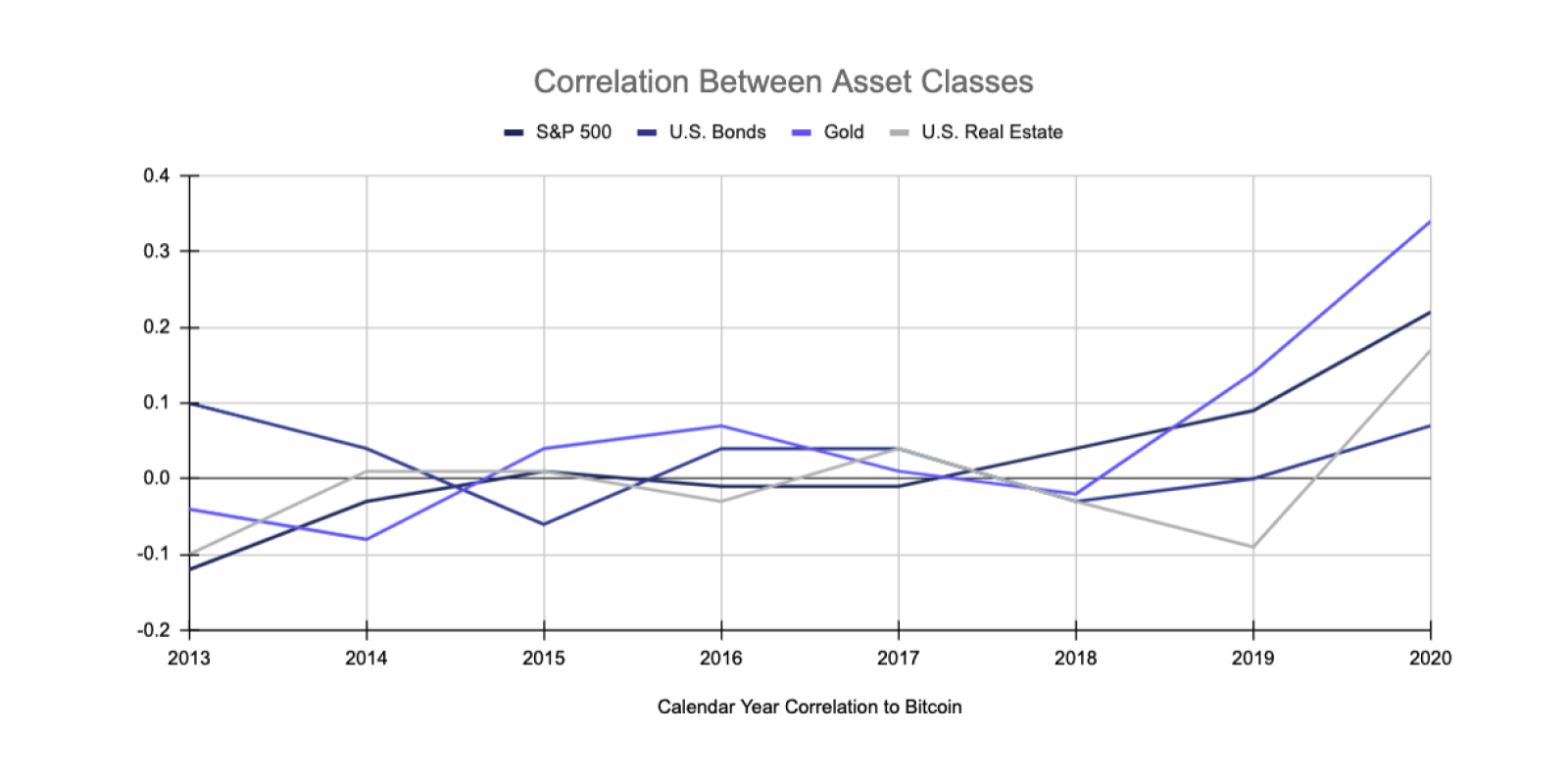

Bitcoin’s correlation structure compared to traditional asset classes can make it a useful tool in portfolio construction. Typically, investing in an asset with low or negative correlation helps enhance diversification and reduce portfolio volatility. Bitcoin has relatively low correlation to traditional assets, being near-zero or negative across the board, with the exception of 2020, as shown in Table 1 and Graph 3. JPMorgan has discussed Bitcoin as an “attractive option for multi-asset portfolios for diversification” and being “less vulnerable to any further appreciation in the dollar.”

Table 1: Correlation of Bitcoin to traditional asset classes.

3.2 Correlation or Coincidence?

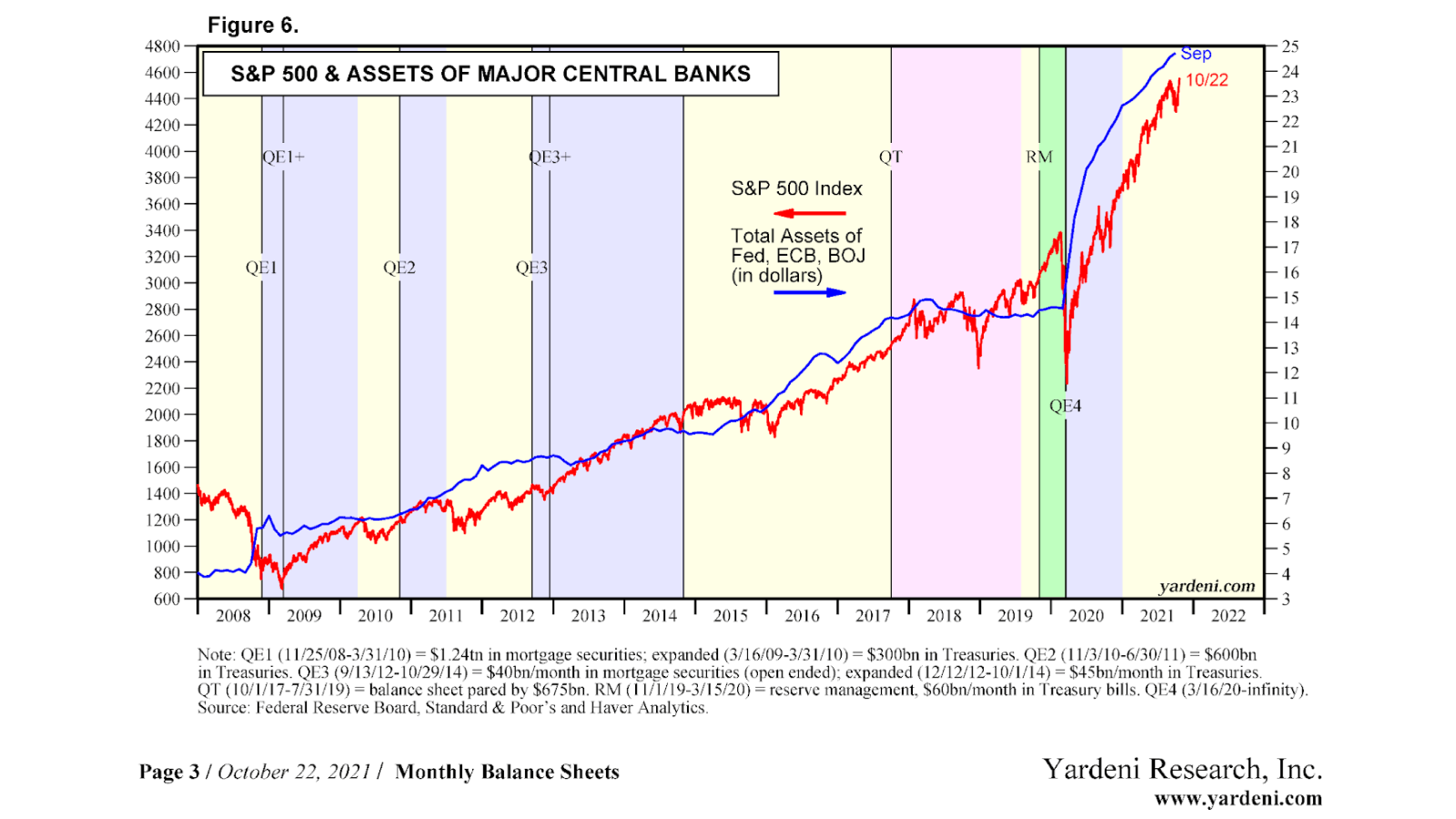

Most Australian and global asset classes entered a bull market following the Covid-19 market crash in March 2020. Over the same period, Bitcoin has seen a 525% increase in price. But is this real correlation or a coincidence? Indeed, many might look at the below chart and see a near 100% correlation between Central Bank balance sheets and asset prices.

Some commentators report that this short term increase in correlation will not continue because the underlying return drivers of Bitcoin are inherently different from other asset classes. Bitcoin is driven by widespread adoption whereas equities and bonds follow more traditional metrics such as interest rates and economic growth. Many predict these fundamental differences will continue to keep Bitcoin’s correlation low relative to other asset classes.

Graph 3: Correlation of Bitcoin to traditional asset classes.

4.0 Managing Bitcoin’s Volatility

When looking at allocating Bitcoin in an investment portfolio, the strategy must be carefully considered. Bitcoin can be treated like any normal investment, where one allocates a certain amount and rebalances accordingly. Commonly asked questions are “how much do we allocate” and “how often do we rebalance it”.

Bitcoin’s high volatility might be a deterrent to some investors but positive contributions can be harnessed through a disciplined rebalancing strategy. Due to its highly volatile nature, rebalancing may be done to manage risk. A certain weight is established and will be rebalanced either through time or target based strategies. Time based rebalances include rebalancing on a set time basis, ranging from monthly to annually. Not rebalancing can significantly alter the risk/return characteristics of a portfolio, while rebalancing too frequently can lead to potentially missed returns. Target based allocation includes establishing a tolerance and allowing the allocation to fluctuate within this range. For example, a portfolio may set a 5% allocation to Bitcoin with a 2.5% tolerance - the allocation can range from 2.5% to 7.5% before rebalancing is performed.

Dollar Cost Average (DCA) investing is another traditional strategy that can be applied to Bitcoin investing, where a fixed amount is invested over recurring periods of time. The intended effect of this is to lower the average price paid for the investment and ultimately maximise returns.

The strategies discussed above are analysed further in the Monochrome Research report Bitcoin in a Portfolio, delving deeper into the effects of rebalancing frequency and allocation size.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.