Share

Introduction

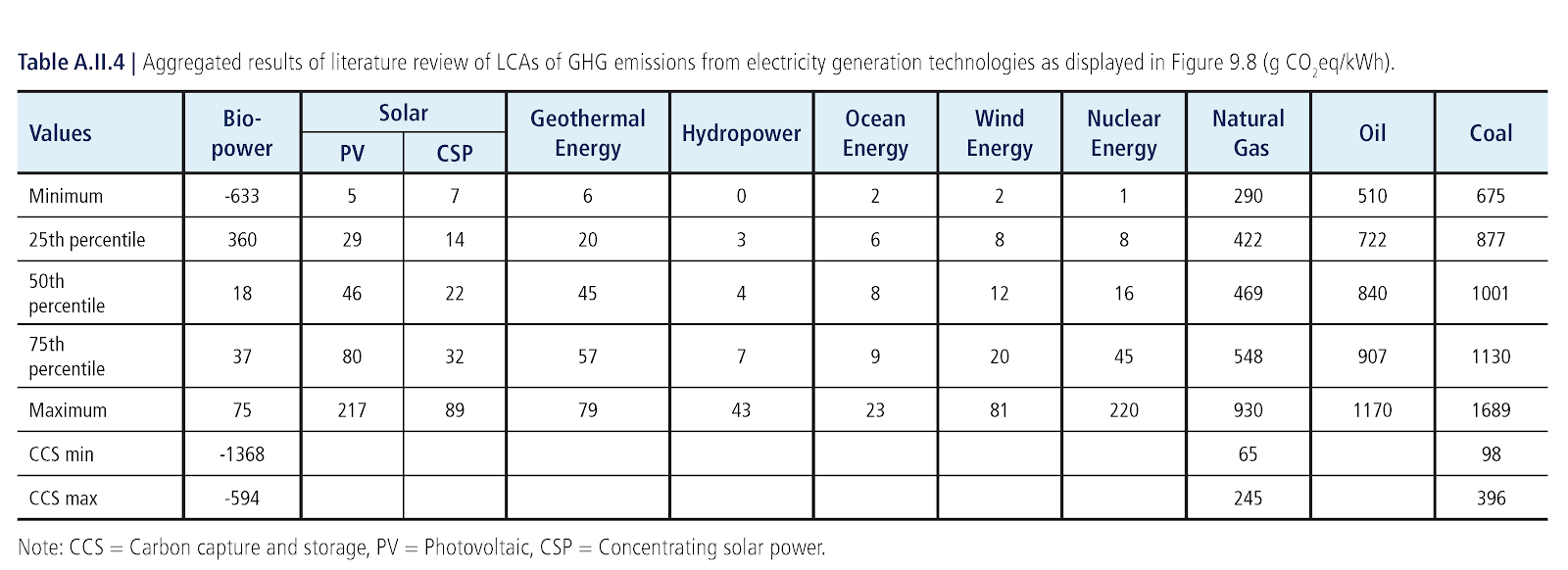

As was highlighted in the introduction to this series, all electrical energy starts its life as “primary energy”, i.e., a ray of sunlight, gust of wind, drop of oil, or lump of coal. Depending on the particular fuel source and generation method, greenhouse gas emissions (GHGs) such as carbon dioxide or methane, are released into the atmosphere as a byproduct. The amount of GHGs (measured in grams of Carbon-Dioxide Equivalents (g CO2eq)) emitted per kilowatt-hour (kWh) of electricity generated is known as carbon intensity (CO2eq/kWh). The International Panel on Climate Change (IPCC) has collected data on carbon intensity to demonstrate the difference between technologies, as is shown in Figure 1 below.

Of relevance to note in the Table is the 50th-%ile scores for all technologies, where there is a clear difference between green technologies and fossil fuels. Of interest to note is that best-in-class Carbon Capture & Storage (CCS) fossil fuel plants are comparable to worst-in-class solar Photovoltaic (PV). This is the level of carbon intensity variation found in generation methods around the world.

Bitcoin’s Electricity Mix & Use

On energy mix, we look to Cambridge University’s data which provides robust Pre-China information. In the turmoil of the Chinese Ban, The Bitcoin Mining Council, which currently represents almost 50% of the network hash rate, presented as a robust secondary source to fill data gaps post-migration. Data on world energy and grids is obtained from Oxford University’s Our World in Data.,

The figure below aggregates data from the two aforementioned sources, and presents them in a table. There you will see the world average’s primary energy and grid mixes by generation technology, as well as Bitcoin’s energy mix pre-and-post China Migration. Data on the “% sustainable technologies” as well as carbon intensity are shown at the bottom. It is clear that Bitcoin outperforms the world average figures.

| Electricity Generation Method | World Primary Energy Mix (2020) | World Grid Mix (2020) | Bitcoin Mix (Pre-China Ban) | Bitcoin Mix (Post-China Ban) |

|---|---|---|---|---|

| Coal | 25.3% | 33.8% | 30.0% | 10.0% |

| Oil | 30.9% | 4.4% | 4.0% | 3.0% |

| Gas | 22.7% | 22.8% | 17.0% | 29.3% |

| Nuclear | 4% | 10.1% | 10.0% | 15.0% |

| Hydroelectric | 6% | 16.8% | 28.0% | 30.0% |

| Solar | 2% | 3.3% | 3.0% | 3.0% |

| Wind | 2% | 6.1% | 8.0% | 9.7% |

| Other Renewables | 7.1% | 2.7% | 0.0% | 0.0% |

| Total % Sustainable** | 21.1% | 39.1% | 49.00% | 57.70% |

Bitcoin’s Energy Use

Earlier in this series, we calculated how much electricity Bitcoin uses by multiplying the average miner efficiency with the network hashrate, resulting in 15.3GW of power draw, the equivalent of 133.8 TWh per year (about 0.5% of the 26,290TWh of electricity produced by the world annually). Now that we understand Bitcoin’s electricity use and generation mix, we can calculate total energy use.

Every time primary energy is converted into electrical energy, some energy goes to waste. Using well established conversion factors, we can work backwards and calculate the primary energy required to produce electricity., Conversion factors (CF) are defined as the proportions of primary energy that are converted to electrical energy. Hydroelectricity is highly efficient and converts 90% of energy at the turbines into electricity at the wire. Coal and oil are less efficient at a 32% conversion factor. Conversion factors of other generation methods, as well as Bitcoin’s overall conversion factor, are presented in Figure 3 below.

| Energy Source | Bitcoin’s Energy Mix Proportion | Conversion Factor | Energy Mix Proportion x Conversion Factor |

|---|---|---|---|

| Coal | 10% | 32% | 3.2% |

| Oil | 4% | 32% | 1.3% |

| Gas | 30% | 44% | 13.2% |

| Nuclear | 15% | 33% | 5.0% |

| Hydroelectric | 30% | 90% | 27.0% |

| Solar | 3% | 39% | 1.2% |

| Wind | 8% | 39% | 3.1% |

| Bitcoin’s Conversion Factor | 53.9% |

Bitcoin’s energy mix implies an overall energy to electricity conversion ratio of approximately 53.9%. This means that the 133.8 TWh of electrical energy used by Bitcoin, divided by 53.9%, results in 252.5 TWh of primary energy. This is equivalent to 0.15% of the world’s primary energy supply of 173,430 TWh.

Bitcoin’s Emissions

Using the 50th-percentile figures shown in Figure 1 above, and Bitcoin’s Energy mix from Figure 2, we can quickly find Bitcoin’s carbon intensity to be 269 grams of CO2e/kWh.

| Energy Source | Bitcoin’s Energy Mix Proportion | Carbon Intensity (g CO2e/kWh) |

|---|---|---|

| Coal | 10% | 1001 |

| Oil | 4% | 840 |

| Gas | 30% | 469 |

| Nuclear | 15% | 16 |

| Hydroelectric | 30% | 4 |

| Solar | 3% | 40 |

| Wind | 8% | 12 |

| Bitcoin’s Carbon Intensity (g CO2e/kWh) | 269 |

From here, simply multiply Bitcoin’s Carbon Intensity of 269g CO2e/kWh by Bitcoin’s yearly electricity use (133.8 TWh) to get to an emissions figure of 36 megatons (MT) of Greenhouse Gases per year, or 0.07% of the world’s 49,360 MT of GHG emissions.

In the next section of this piece, we will dig into what emissions are, the difference between them and the need to account for all of them, not just carbon dioxide.

Emissions - Greenhouse Gases vs Carbon Dioxide

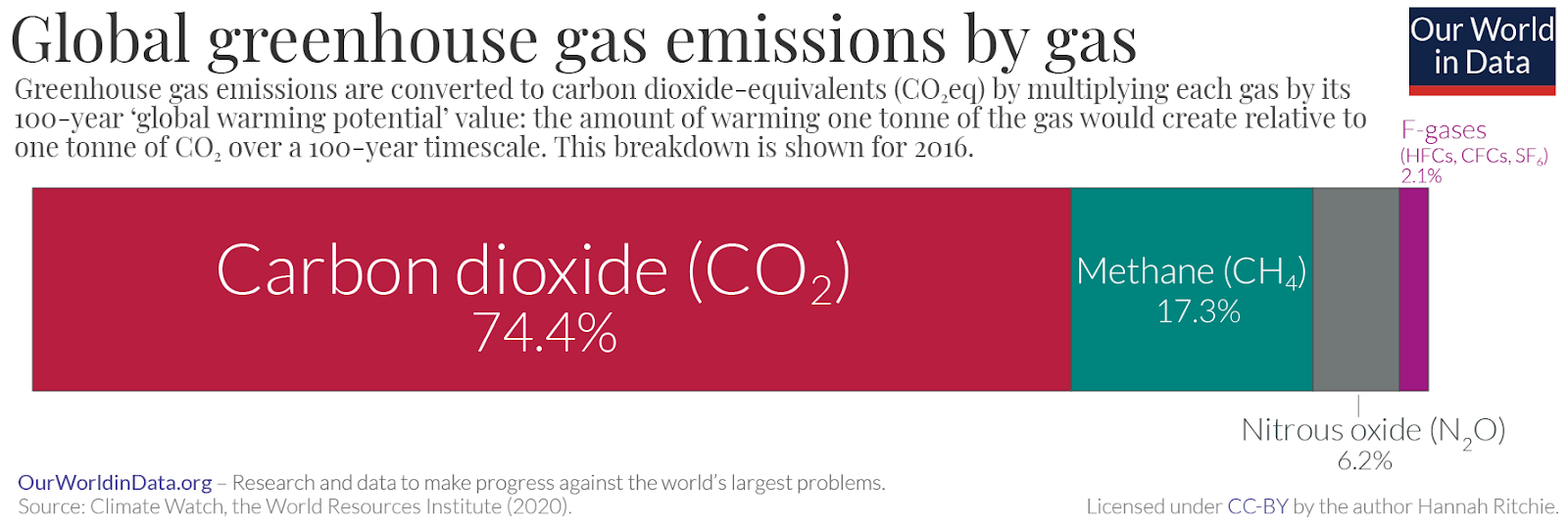

By definition, greenhouse gases (GHGs) capture and reflect heat back to the Earth. There are four categories of GHG, these being carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and fluorinated gases. Therefore, similar to how electricity is a subset of energy, carbon dioxide is a subset of greenhouse gases, as shown in the figure below.

An Introduction to Methane, and its Negative Environmental Impacts

Methane is most prevalently emitted into the atmosphere through the production, processing and storage of natural gas and petroleum, which comprises 30% of total methane emissions. Methane is also emitted through landfill and coal mining, which comprise about 17% and 7% of methane emissions, respectively. Methane is the second-most prevalent GHG in the world after CO2, but has 56-times more warming potential., As such, methane emissions are an environmental issue that must be addressed.

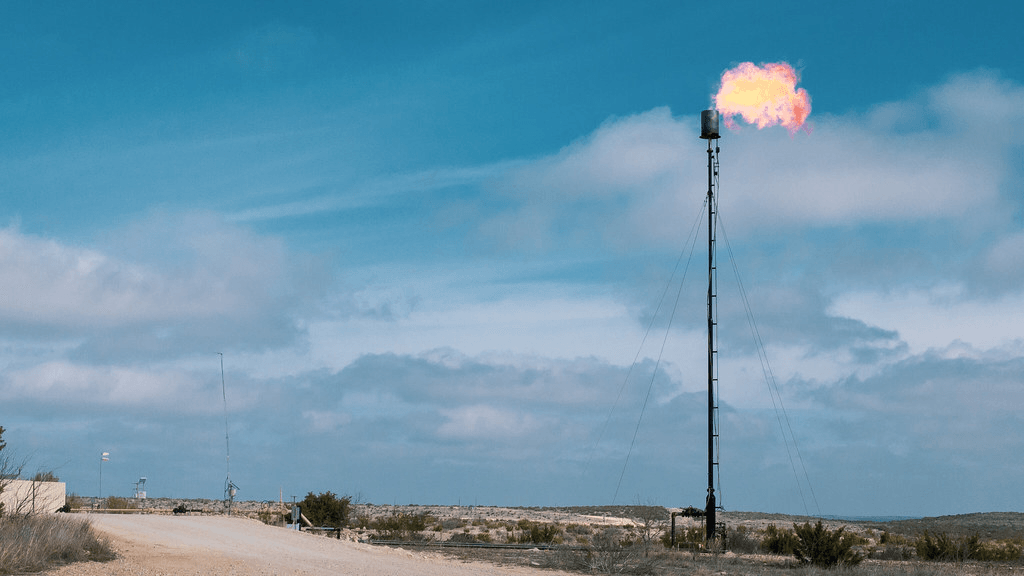

In the oil and gas fields, methane is emitted into the environment through 2 methods; venting and flaring. Vented methane is methane immediately released straight into the atmosphere, which is suboptimal environmentally. With flaring, this vented methane is combusted and converted into to water vapour, heat, and the relatively more favourable carbon-dioxide. Whilst flaring reduces environmental impact substantially, the practice is still susceptible to heavy winds leading to incomplete combustion of the methane, resulting in some methane still being released into the environment.

Thus, reducing the amount of vented and flared methane would be instrumental in helping reduce the impacts of climate change.

How Bitcoin Currently Offsets Flared Methane

Bitcoin does not need an electric grid per se - only an energy source. Bitcoin can contribute to reducing the impacts of climate change as it can use flared methane, or any waste energy for that matter, to power the network. The most notable oil and gas corporations engaging in this scheme are ExxonMobil and ConocoPhillips, which have partnered with flared methane bitcoin mining specialist Crusoe Engineering to redirect their excess gas from being flared to being used to power bitcoin miners.

Instead of flaring the gas, or worse, venting it, Bitcoin miners transport their equipment to an oil field with active flares, then divert the natural gas to generators that generate electricity to power the Bitcoin mining rigs. This solution mitigates the negative environmental effects from just flaring gas by up to 63%, and has significant environmental and economic benefits to oil and gas companies who can now both clean and monetize their waste through partnerships with Bitcoin miners.

Since Bitcoin can be powered by stranded energy sources across the globe, Bitcoin miners will modify their mining operations to take advantage of cheap energy of any kind or in any location given that the incentive exists.

Conclusion

Bitcoin has gradually shifted towards cleaner and more sustainable energy sources over time, and most importantly, shifted away from one of the dirtiest, least transparent power grids in the world in China, which has resulted in a dramatic improvement in carbon emissions. Bitcoin can continue to have a positive impact on the environment by feeding on lethal waste greenhouse gases, particularly flared methane, to reduce the amount of dangerous GHGs emitted into the atmosphere. Finally, we saw that Bitcoin uses only 0.15% of The World’s Primary Energy, 0.5% of its electricity, and contributes 0.07% of The World’s GHG emissions.

Ultimately however, the energy mix of international grids is what drives Bitcoin’s emissions, and indeed, global industry and commerce’s emissions. Therefore, the responsibility falls on world governments to take action through proper incentives and regulations so that global emissions targets are met. In the meantime, Bitcoin miners will remain on the lookout for the cheapest form of energy available to them, which is increasingly becoming green.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.