Share

Introduction

In this second instalment of the E in ESG series from Monochrome Research, we explain Bitcoin’s Proof-of-Work (PoW) consensus mechanism, the source of its power consumption. An explanation of both endogenous and exogenous incentives for Bitcoin miners will also be given, and a breakdown of the Bitcoin mining industry’s position as a near-perfectly competitive market will be analysed.

Proof-of-Work

Bitcoin's creator(s) hypothesised that “a purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” To achieve this, a peer-to-peer network with a timestamped, append-only, distributed ledger, commonly known as The Blockchain, was proposed. To keep all actors honest, miners are required to expend computational energy to earn the right to add the next block of transactions to The Blockchain, and the associated economic rewards that come with it.

As mentioned in Part 1 of the E in ESG Series, Bitcoin’s energy consumption is due to the Proof-of-Work consensus mechanism which ensures the blockchain remains secure and transparent. To oversimplify an extremely technical process, Bitcoin mining is effectively guessing a number, “hashing” it with a universally agreed upon algorithm, and hoping that you are the first to guess correctly. You can think of performing a single hash as scratching a single lottery ticket. You can perform a hash by hand, however, modern mining rigs undertake several trillion hashes per second (TH/s), or, to continue the analogy, scratch trillions of lottery tickets per second. All tickets are identical, save their unique serial number. The more tickets you scratch, the higher the chance of winning the lottery. If you control 10% of the network hash power, you could expect that, on average, you will earn 10% of block rewards. It takes energy to scratch the ticket. If you have the right number, but a bad ticket (i.e. you are trying to behave dishonestly), all your effort scratching tickets goes to waste. Most importantly, it is far more costly to forge a winning ticket than to participate honestly. Aside from upfront expenditure on hardware, there are very few barriers to entry to participate in mining.

At any moment in time, on average, the network is only ten minutes away from the next correct guess. Every two weeks, or more precisely 2016 blocks, the Bitcoin network checks to see if a ten minute average cadence was achieved. If the correct guesses occur too frequently, the set of numbers to guess from, or, “the difficulty” increases to bring the frequency back to ten minutes. If the correct guesses are too infrequent, the difficulty is reduced, and the pool of numbers to guess from decreases. This defining feature of Bitcoin, known as “The Difficulty Adjustment” guarantees the stability of the predetermined issuance schedule. It is in this way, and only this way, that distribution of coins can be fair. Every single Bitcoin in history, including the ones mined by Satoshi themselves, have all been mined at the fair market rate.

Thanks to PoW, all of this is achieved with zero human intervention, coordination or management.

Incentives

Miners invest energy into bitcoin because they are incentivised in several ways. As long as the cost to mine is lower than the market price of bitcoin, there exists an inherent incentive to continue mining. Additional incentives can be broken down into endogenous incentives, i.e., economic incentives built into the Bitcoin Protocol, and exogenous incentives, i.e., the market incentives and pressures to remain alive and profitable.

Endogenous Incentives

Bitcoin miners are incentivised with the “block reward”, consisting of the predetermined supply issuance for the successful mining of a block, called the “block subsidy” and all transaction fees associated with that block. Early Bitcoin mining income was heavily skewed towards block rewards, with the initial reward being 50 bitcoin per block. The block reward halves every 210,000 blocks, or, roughly 4 years, which means mining income will eventually comprise strictly of transaction fees. The block reward as of May 2022 is 6.25 bitcoin per block, with transaction fees becoming a larger percentage of miner income.

Exogenous Incentives

Bitcoin mining hardware is application specific and can only be used for mining bitcoin (alongside a few other SHA256-based micro-cap altcoins). This incentivises miners to ensure Bitcoin prospers, otherwise they face their billions of dollars invested in mining infrastructure being rendered worthless. As Bitcoin continues to prosper, incentives grow to capture more profit, meaning competition will grow and pressure to stay alive will increase. Miners are thus incentivised to continue expanding and improving their operations to maintain their share of the network (or “hashrate”). This circularity of incentives makes them robust and self reinforcing.

Perfect Competition

The example of “the hypothetical firm in a perfectly competitive market” is taught in most introductory economics classes. A literature review of primary academic texts identifies eight recurring conditions that define a perfectly competitive market, as shown in the table below. The following subsections will provide a point-by-point demonstration of how Bitcoin mining is a near-perfectly competitive market, and what this typically means for industry competitors.

| Homogenous Products Non-increasing Returns to Scale No Barriers to Entry or Exit | Perfect Factor Mobility Guaranteed Property Rights Many Buyers and Sellers | Zero Transaction Costs Perfect Information |

|---|

Homogenous Products, Guaranteed Property Rights and Zero Transaction Costs

Bitcoin’s digital signature algorithm, backed by proof-of-work mining, guarantees ownership rights. Bitcoins are entries in a globally distributed ledger, and are completely homogenous and fungible. Bitcoin transaction costs are not, and will never be zero, however transactions on Bitcoin’s secondary layers (and higher) will eventually approach zero for most end-users. Storing Bitcoins is possible without incurring any costs - one could remember a “seed phrase”, a list of words that contain all the information needed to access and spend funds. All three criteria are met by Bitcoin.

Perfect Information and Many Buyers and Sellers

Research from Crypto.com estimates that there are currently 176 million Bitcoin users globally. While there is no explicit definition of “many”, a point could be made that 176 million users are few compared to tech giants such as Facebook, Netflix and YouTube. In addition, Bitcoin’s volatility is still extremely high, which can impact the flow of market information. If Bitcoin’s user-base grows into the billions much like the tech giants’ user-bases, then both of these criteria will be met.

Non-increasing Returns to Scale

If more than 51% of the network hashrate is owned by a dishonest entity, they can potentially double spend their funds and prevent others from transacting on the network, effectively destroying the value proposition of Bitcoin. However, any attacker who amasses the necessary hardware and energy to control more than 51% of the network should rationally be more incentivised to earn 51% of the block reward, rather “than to undermine the system and the validity of his own wealth.” To that end, Bitcoin has never been openly 51%-attacked, and will likely remain so due to semiconductor shortages, the incentive structure of Bitcoin and cost prohibitive factors. With this in mind, a cloud mining platform called GHash.io attracted over 51% of the network’s hashrate to their mining pool in mid-2014. The media described the event as a “doomsday scenario”, which led to mass user panic and migration away from the platform, eventually causing GHash.io to shut down. It would be far more difficult for a pool to attract 51% of hashrate 8 years on, with exponentially more industry participants. With Bitcoin mining, returns stop scaling, and excessive growth can even put you out of business.

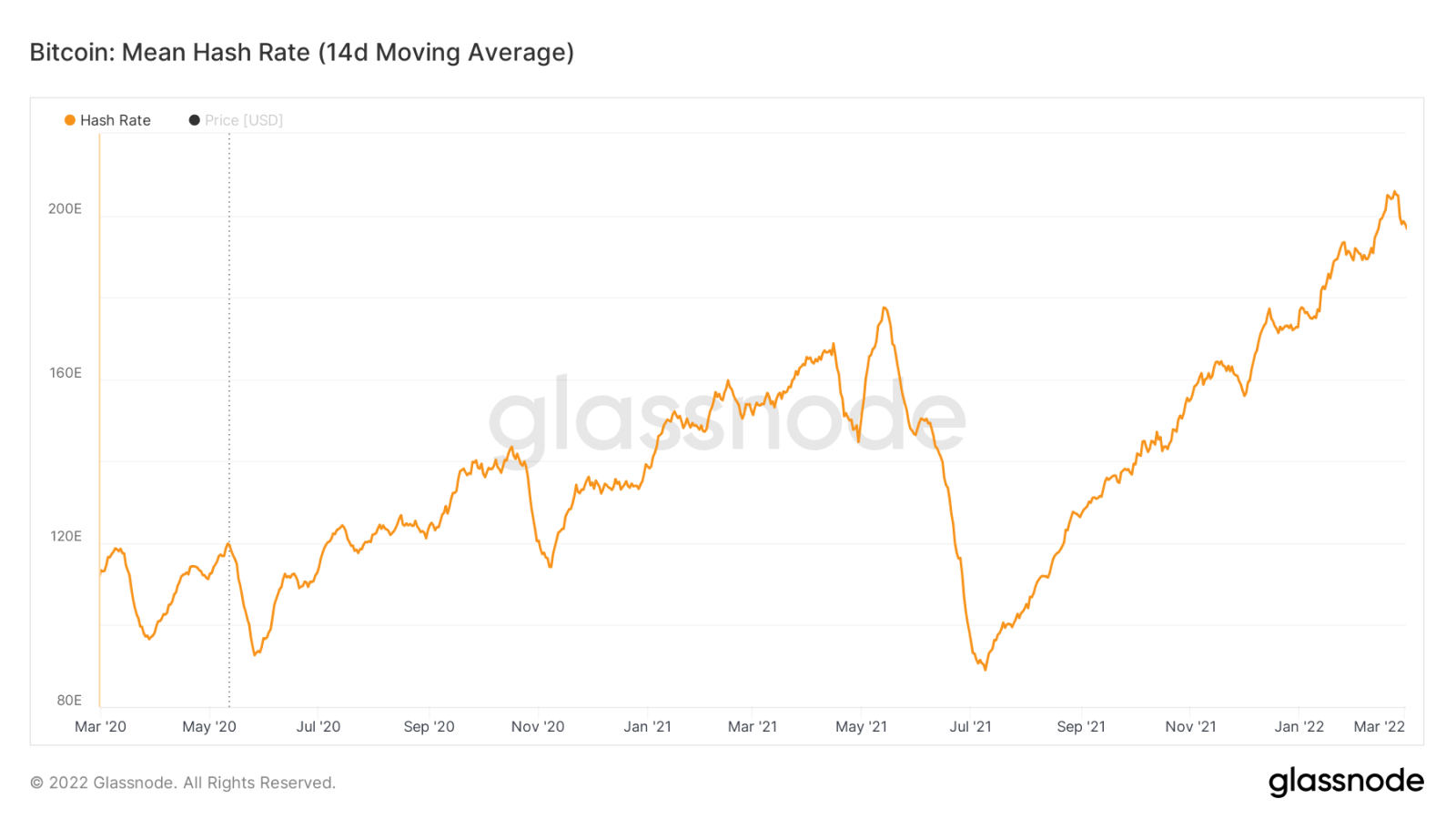

No Barriers to Entry or Exit and Perfect Factor Mobility Bitcoin’s mobility has best been demonstrated by the migration of Chinese miners. Prior to miners being expelled in mid-2021, miners within China operated within coal-fired regions like Xinjian during late autumn, winter and spring during ‘dry season’ and migrated to regions with significant temporary overcapacities in low-cost hydropower in areas such as Sichuan during the ‘wet season’ between May and October 2020, in Figure 1 below. Here, approximately 20-25% of the total network hashrate is able to be relocated in a matter of weeks. Figure 1 illustrates the more extreme example when miners faced expulsion from China in late-May 2021, causing the 14-day average hashrate to fall almost 50% to 89.0 exahashes per second (EH/s) on 9 July 2021 from an all time high of 177.5 EH/s on 13 May 2021. After one month however, over 25% of the hashrate was back online, after 3 months, the majority, almost two-thirds, had returned, and just under 6 months later, on 2 January 2022, an all-time high 14-day average hashrate of 177.5 EH/s was reached. Although brand new mining hardware partially accounts for the increase in network hashrate, ongoing global semiconductor and COVID-related supply chain issues meant that the impact of new hardware was negligible. Bitcoin can essentially be mined anywhere with a power source and internet connection, allowing it to recover from major shocks with relative ease; ultimately demonstrating its high factor mobility and limited barriers to entry or exit.

Implications of Perfect Competition

Economic profit tends to zero in long-term equilibrium in a perfectly competitive market, and the marginal cost of producing and the market price oscillate around an equilibrium point. Therefore, so long as the price of bitcoin is greater than the cost to mine it, competition will enter the market to close the gap, and vice versa. In such competitive markets, there is also a natural tendency for the market to be dominated by three or four players., The Pareto Principle, also known as the 80/20 rule, states 20% of the market participants will tend to control 80% of the market. In terms of Bitcoin's mining pools, the top six collectively control 77.2% of the total hashrate, with the biggest pool, Foundry Digital, controlling 19.2% of hashrate, and ViaBTC, the sixth biggest, controlling 9.7%. As will be discussed in the next section, the only way to stay in business in such an environment is through cost and/or innovation leadership.

Cost Leadership

There are two main routes to cost leadership; having the lowest capital expenditure (CAPEX) per unit of hashing and/or having the lowest operating expenditure (OPEX) per unit of hashing. For the former, this may involve a miner fabricating their own ASIC hardware to save on the fabricator's margin, or developing favourable relationships with ASIC manufacturers, infrastructure providers and other partners throughout the capital expenditure supply chain. In terms of OPEX, cost leadership could mean finding cheaper power and hosting facilities than your competitors, or tailoring your energy inputs and datacenter model to the type of hardware you deploy. Miners are not necessarily environmentalists, however, the cheapest power in the world is increasingly becoming renewable.

Innovation Leadership

Innovation leadership relates to doing things better than your competitors rather than cheaper. The two broad areas that Bitcoin miners can innovate within are their technological capabilities and managerial approach.

Whilst not as easy to measure as improvements in cost or energy per hashing unit, innovation in management and entrepreneurial techniques can make or break a business. For example, large Chinese miners who had robust risk management and business continuity plans in place in the face of increasingly hostile legislation, were able to relocate their operations with speed and minimal disruption and financial loss. Financially innovative and publicly listed miners also have the benefit of access to capital markets for funding to take advantage of or damp market shocks. Finally, innovation in procurement through industry partnerships can also provide a competitive edge.

Technological innovation will be discussed in the next part of our series, where we have a look at the current state of the network.

Conclusion

Bitcoin consumes vast amounts of energy due to the proof-of-work mechanism that ensures the blockchain remains fair, transparent, and secure. The miners which comprise the network are first incentivised to capture the block rewards (endogenous incentives), and then incentivised to stay and even grow in order to remain competitive (exogenous incentives). It is also a near-perfectly competitive market, meeting most academic criteria. Finally, the only hope miners have of staying in business is through innovation in the OPEX and CAPEX supply chains, and innovation in their managerial techniques.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.