Share

Learning Outcomes

In this piece, you will learn the following introductory concepts:

- Bitcoin mining fundamentals and drivers of energy use

- The current state of Bitcoin’s energy use and emissions

- The differences between energy, electricity, and emissions

- How Bitcoin is currently supporting renewable-based power grids, and

- How Bitcoin is currently driving energy innovation

Introduction

In this five-part series on Bitcoin and the environment, we aim to deliver a thorough overview and context of Bitcoin’s energy use and environmental impact. First, one must understand what drives Bitcoin’s energy use. From there we provide an overview of the current state of the Bitcoin Network from an energy consumption point of view, alongside important industry trends and metrics. Bitcoin is frequently subject to interrogation, sometimes questioning its energy use, other times its electricity use, and other times its emissions. By the end of this series, the reader will be able to differentiate between electricity, energy and emissions with aplomb, as well as obtain a comprehensive understanding of global data on all of the above and where Bitcoin fits in. Finally, we close with how Bitcoin currently has, and will continue to have, unbounded further potential to be a driver of energy innovation by being a buyer of first- and last- resort for energy utilities and providers.

Drivers of Bitcoin’s Energy Use

Bitcoin’s energy usage stems from the use of the “Proof-of-Work” consensus mechanism to ensure that the blockchain remains secure, true and transparent. This requires “miners” to expend computational energy, powered by electricity, to win the right to add the next block of transactions to the Bitcoin Blockchain, and thus reap the economic rewards associated with that process.

Energy is invested into Bitcoin because of the economic incentive to do so. Rational reasoning tells us that if the price of bitcoin is higher than the costs associated with mining, then miners will enter the market until that gap goes to zero, and vice versa - effectively causing energy price arbitrage by using highly commoditized, application-specific hardware. These inherent incentives can be broken down into endogenous (incentives inherent within Bitcoin) and exogenous (external) incentives.

The endogenous incentives come from the “block reward.” The block reward consists of a block subsidy, and all transaction fees associated with mining that block. The block subsidy is how Bitcoin will initially bootstrap itself and issue all 21 million units of Bitcoin between now and the year ~2136. The subsidy began at 50 bitcoins per block and halves roughly every four years, with the current subsidy being 6.25 bitcoins per block.

Once miners are operating, this application specific infrastructure further incentivises them to keep mining and ensures the prosperity of Bitcoin, otherwise the vast amounts of capital spent on mining equipment would be rendered redundant. As Bitcoin continues to prosper, more parties will be incentivised to capture profit, increasing competition. Thus, miners are exogenously incentivised to continue innovating in their operations and increasing their total computing power, or “Hashrate”, if they want to remain in business. This circularity of incentives makes them self-reinforcing and robust.

Bitcoin mining is a near-perfectly competitive market, and perfect competition, and its implications on market dynamics, will be fleshed out in further detail in Part 2 of this series.

State of The Network

As discussed above, Bitcoin mining infrastructure is application specific and purpose built. The mining hardware used is called an Application-Specific Integrated Circuit (ASIC) miner. ASIC miners are superior to Central Processing Units (CPUs) and Graphics Processing Units (GPUs) found in typical home and business computers, as they are designed to undertake a specific function extremely efficiently. As at time of writing, the current top-of-the-line ASIC miner, the Bitmain Antminer S19j Pro, can achieve a hashrate of 104 terahashes per second (TH/s), at an efficiency of 30W/TH, and a price of US$10,000. This is almost a million times more power, yet only four times the price, than the 124 megahashes per second (MH/s) performed by the US$2,500 Nvidia GeForce 3090, today’s most powerful consumer GPU offering. Data from Cambridge and Coinshares suggest an average network efficiency of 70W/TH, possibly as low as 59W/TH.

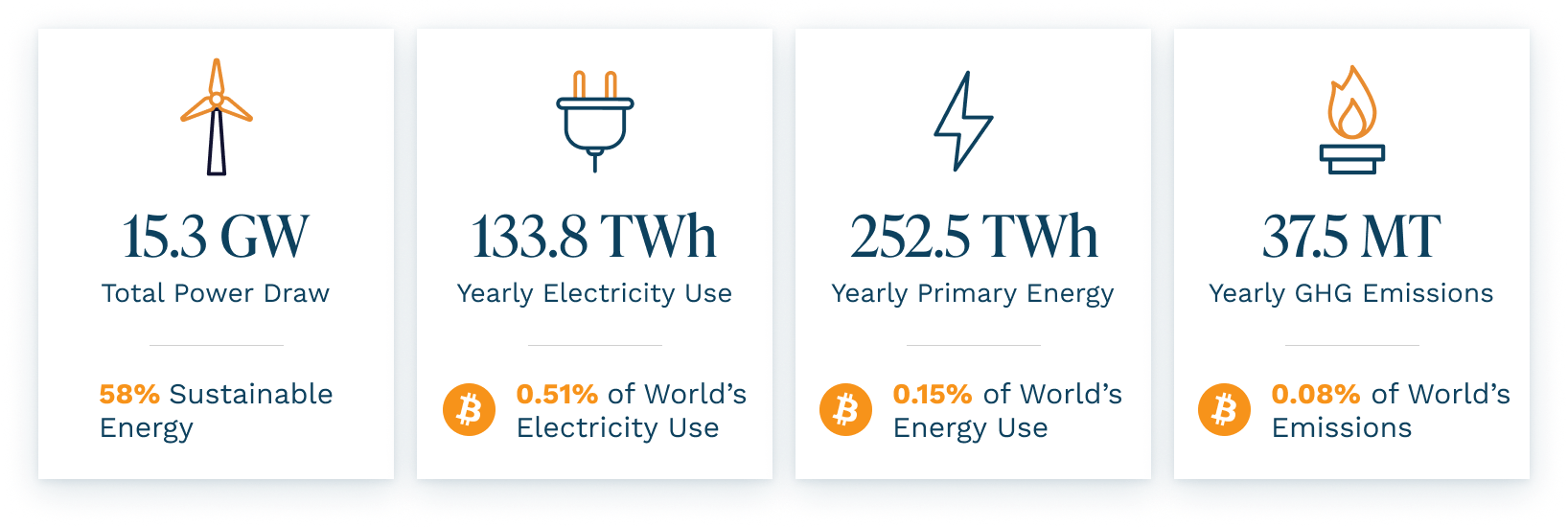

Based on data as at 21/05/2022, Bitcoin had a 14-day average network hashrate of 218.2 exahashes per second (EH/s), multiplied by the average network efficiency of 70W/TH, results in an estimated draw of 15.3 GW of power, or 133.8 terawatt-hours (TWh) of electricity per year. Based on best-estimates of Bitcoin’s energy mix, this results in the emission of 37.5 megatons (MT) of greenhouse gas emissions per year, or 0.08% of the world’s 49,360 MT of emissions. This electricity use equates to 252.5 TWh of primary energy consumed per year. The calculation methodology behind the above figures is laid out in far greater detail later in Part III of the series.

Energy and Emissions

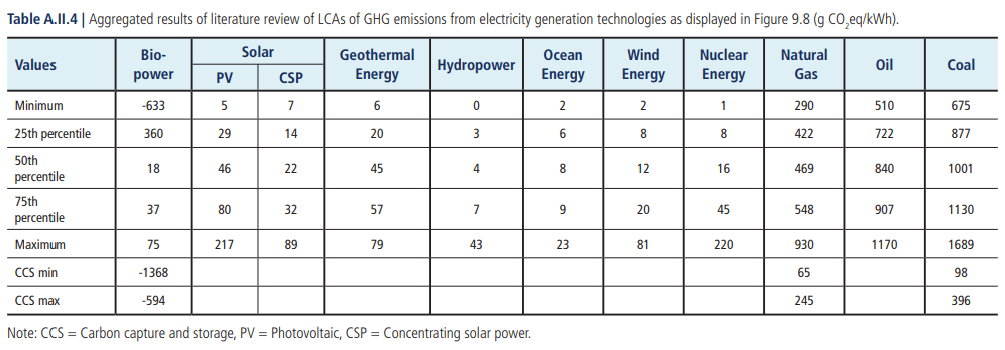

Every type of electricity generation differs in terms of carbon intensity. Numbers from The International Panel on Climate Change reveal that fossil fuels such as oil, coal and natural gas emit higher concentrations of greenhouse gases per kilowatt hour (kWh) than sustainable energy sources, as depicted in the table below. Solar, wind, geothermal, ocean, bio- and hydro-power are considered to be “renewables”, whereas “sustainable” also includes nuclear power. Interestingly however, best in class Carbon Capture and Storage (CCS) fossil fuel plants are comparable to 75th-percentile and worst-in-class renewables.

Figure 1 - IPCC Data on Carbon Intensity of Various Generation Types

China passed laws in 2021 to ‘root out “illegal” cryptocurrency activity.’ This caused a miner “migration” from China to other countries. As a result, a larger proportion of Bitcoin’s energy mix has become sustainable post-migration, as most Chinese miners included worst-in-class coal as a large percentage of their energy mix. It is currently estimated that 58.8% of energy used by miners now comes from sustainable sources, compared to 49% pre-migration.,

Conversely, the US and Chinese electricity grids use 31.4% and 16.4% of sustainable energy sources respectively. This shows the Bitcoin network’s growing sustainability over time and its sustainability relative to world grids.

While the terms greenhouse gases (GHG) and carbon dioxide (CO2) are often used to refer to the same concept in conversation, not all GHGs are CO2. A particularly more dangerous GHG than CO2 is methane; over a 20 year period, methane is 56 times more warming than CO2. In 2020 alone, 8 megatonnes (Mt) of methane was flared by Oil and Gas producers.

Bitcoin is starting to offset this negative externality by incentivising oil companies to monetise their methane by partnering with Bitcoin Miners. This process, already in use by oil and gas giants ExxonMobil and ConocoPhillips, results in a greenhouse gas emissions reduction of 63% compared to flaring alone.

Energy and Electricity

Whilst the words energy and electricity are often used interchangeably in conversation, they are quite distinct. Electricity is a form of energy, similar to sound and heat. In fact, of the 173,340 TWh of primary energy produced on Earth in 2019, only 26,290 TWh was electrical, or roughly ~15%. All electricity is generated using a primary energy source, be it oil, sunlight or wind, with the conversion output differing substantially across different generation methods.

Deriving a figure for Bitcoin’s primary energy consumption requires conversion factors for the types of primary energy sources Bitcoin uses. Based on the energy sources present in Bitcoin’s sustainable energy mix and their respective proportions and conversion ratios, the Bitcoin network has an estimated energy to electricity conversion ratio of 54% (electricity conversion is covered in greater depth in Part 4 of the series. This implies that 252.5 TWh of primary energy is needed to produce the 133.8 TWh of electrical energy used by Bitcoin annually. This represents approximately 0.08% of the world’s annual primary energy production of 173,340 TWh, and roughly 0.5% of the world’s annual electricity generation of 26,290 TWh.

Bitcoin can only be created through mining, which necessitates the need for energy. While this is currently primarily done through the medium of grid-based electricity, in theory Bitcoin can be mined using any form of energy, such as flared methane (as discussed earlier) or otherwise stranded energy.

Bitcoin as a Driver of Energy Innovation

Bitcoin miners are willing to do whatever it takes to get the cheapest energy possible. This has increasingly meant that Bitcoin miners have acted as buyers-of-last resort for stranded and wasted energy, as well as buyers-of-first resort by taking risks on energy sources that are still proving out. For example, companies such as Compass Mining have signed deals with nuclear fission companies to be supplied with cheap nuclear energy to be used for mining purposes.

Other problems encountered by current grids are curtailed energy, which is produced but unsold energy; stranded energy, which is isolated energy; and unpredictable production in renewable grids. To address this, Bitcoin miners, some of whom are publicly listed companies, locate mobile data centres, primarily shipping containers filled with mining rigs, and plumb the flared methane directly into a generator to power the data centre. This has the effect of reducing the environmental impact of flared methane, as well as turning wasted energy into a source of profit.

A potential solution to variable production is by introducing an adjustable load, which is a service Bitcoin miners can provide to a grid operator, commonly referred to as a “controlled load resource” (CLR). This is particularly important with regards to normalising renewable sources of energy whose energy supplies fluctuate throughout the day, such as solar and wind energy. In Texas, 100MW of mining power is being used as a controllable load resource in the ERCOT (Electricity Reliability Council of Texas) grid, allowing Bitcoin miners to level the demand of energy automatically., The value that miners provide to an electricity grid by acting as a CLR was witnessed in February 2022 where Bitcoin miners curtailed their energy consumption at the Texas ERCOT grid, and helped provide excess power reserves in response to a winter storm, which could have otherwise left many Texans without power.

Conclusion

After merely scratching the surface in the introduction to this series, Bitcoin’s environmental impact can be seen in a new light when put into appropriate context. Many may have been surprised to learn that on a “carbon per unit of energy” basis, there is no major country or industry in the world cleaner than Bitcoin. Further, it was shown that mining can feed on wasted energy, drive competition and innovation in energy markets and add stability to highly renewable grids. Finally, it was shown that Bitcoin will only get cleaner and more efficient over time, thanks to its robust built-in incentives system. **Bitcoin doesn’t waste energy; It saves it. **

The following four parts of this series will discuss each of the major topics discussed above in long form, and provide detailed calculation methodologies where relevant.

Part II - Drivers of Bitcoin Energy Use

Part III - State of the Network

Part IV - Electricity, Energy and Emissions

Part V - Bitcoin as a Driver of Energy Innovation

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.